Cryto, Home, Lifestyle, Style, Uncategorized

XM – The Big Picture

The Big Picture

Founded in 2009, XM Group (“XM” or “Group”) offers forex and CFDs on cryptocurrencies*, commodities, indices, metals, energies, and stocks.

The Group provides its services via four entities: Trading Point of Financial Instruments Ltd (Cyprus), Trading Point of Financial Instruments Pty Limited (Australia), XM Global Limited (Belize), and Trading Point MENA Limited (Dubai).

XM provides access to popular trading platforms MetaTrader 4, and MetaTrader 5 and offers multiple types of trading accounts* such as Micro, Standard, Ultra Low and XM Zero. The broker offers an Islamic Account option for each of these accounts.

The broker has multiple options for deposits and withdrawals, including credit cards, wire transfers, and e-wallets.

8 of XM Key Takeaways For 2022

- We evaluated XM across 9 categories (Trust and Stability, Fees, Tradable Instruments, Account Types, Deposit and Withdrawal, Research, Customer Support, Education, and Platforms and Tools).

- XM received a decent score in the Trust and Stability category as it has two entities that are regulated by Tier 1 regulators.

- The broker has a good score in the Fees category thanks to moderate spreads in the Standard Account and reasonable swap rates.

- XM received an almost perfect score in the Account Types category as it offers more than three types of accounts and has an Islamic Account option for each.

- The broker also received a high score in the Deposit and Withdrawal category due to a wide range of deposit & withdrawal options, as well as the absence of deposit & withdrawal fees.

- XM got a high score in the Research & Education categories as it offers solid educational & research support, including live webinars and trading courses.

- The broker also got a good score in the Customer Support category thanks to the timely and professional answers of the support team.

- XM scored well in the Platforms and Tools category as it offers the widely popular MetaTrader 4 and MetaTrader 5.

Who is XM For?

XM will suit both beginner and advanced traders. Beginner traders will benefit from the strong educational support provided by the broker. In addition, the minimum deposit is just $5, which provides novices with an opportunity to make their first trades without committing too much money.

Advanced traders will likely focus on the tight-spreads, commission-based XM Zero Account and/or the Ultra-Low account, while enjoying strong research support.

XM Pros and Cons

|

|

XM Full Review

Trust

XM has entities that are regulated by CySec (Cyprus), ASIC (Australia), FSC (Belize), and DFSA (Dubai). The broker received an above-average score in the Trust category in our rating as its entities are regulated by Tier 1, Tier 2, and Tier 3 regulators.

XM Regulations

XM operates under four entities:

- Trading Point of Financial Instruments Ltd is regulated by the Cyprus Securities and Exchange Commission (CySEC). We rate CySEC as a Tier 1 regulator.

- Trading Point of Financial Instruments Pty Limited is regulated by the Australian Securities & Investments Commission (ASIC). We rate ASIC as a Tier 1 regulator.

- XM Global Limited is regulated by the Financial Services Commission of Belize (FSC). We rate FSC as a Tier 3 regulator.

- Trading Point MENA Limited is regulated by the Dubai Financial Services Authority (DFSA). We rate DFSA as a Tier 2 regulator.

XM license record on CySEC.

Why is It Important to Know Where Your Broker Subsidiary Is Regulated?

Each regulator has its requirements for brokers, which may differ materially. Traders must understand these differences to evaluate whether the broker suits their needs.

For example, Trading Point of Financial Instruments Ltd is subject to the oversight of CySEC, which is a Tier 1 regulator. ASIC, which regulates Trading Point of Financial Instruments Pty, is also a Tier 1 regulator.

Trading Point MENA Limited is subject to the oversight of DFSA, a Tier 2 regulator, while XM Global Limited is regulated by FSC, a Tier 3 regulator.

All XM entities offer negative balance protection, which means that clients will not lose more money than they have in their accounts.

In addition, all XM entities hold their funds separately from the clients’ funds. This is important as it protects clients’ money if the broker has financial problems.

Is XM Safe to Trade With?

XM has entities regulated by Tier 1 regulators (CySEC, ASIC), a Tier 2 regulator (DFSA), and a Tier 3 regulator (FSC). All entities separate their funds from the funds of the investors and provide negative balance protection. Traders who open an account with Trading Point of Financial Instruments Ltd. will enjoy additional protection in the form of a compensation scheme that covers losses of up to €20,000 or 90% of the claim, whichever is lower, in case the broker is unable to fulfil its obligations.

Stability and Transparency

In our tests for the Trust category, we also cover factors relating to stability and transparency. Here, we focused on how long the broker has been in business, the size of the company, and how transparent they are in terms of information being readily available.

The information about XM regulations can be found on the dedicated page of the company’s website. There’s also a separate page for legal documents.

The company’s Trading Account Types page provides important information about available accounts, including base currency options, contract sizes, typical spreads, and commissions. The broker also offers forex calculators, including a swap calculator, which is important for those traders who hold their positions overnight.

In summary, our findings indicate that XM can be regarded as having a high level of trust and stability due to the following factors:

- Regulated by Tier 1, Tier 2, and Tier 3 regulators.

- More than 13 years in business.

- Transparency on regulations and fees on the company’s website.

Fees

XM offers competitive spreads in its Standard Account and does not charge commissions. Swap fees are also moderate. In our rating, XM received a high score in the Fees category.

XM Trading Fees

For this review, we tested XM Standard Account. In this account, XM charges spreads and swap/rollover fees. Traders should note that spreads are variable and depend on the instrument and liquidity situation at a certain point in time. Swap fees can be determined using the swap calculator.

Traders should also keep in mind that Cypriot entity offers XM Zero Accounts. These are commission-based accounts with tighter spreads. The commission is based on volume – $3.5 per $100,000 traded.

XM Spreads

We tested the spread on the XM Standard Account during the London open at 8 am UK time and just after the US open at 2.45pm UK time. These are the most actively traded times.

| Instrument | Live spread AM | Live spread PM |

| EURUSD | 1.6 | 1.8 |

| GBPJPY | 3.5 | 3.7 |

| Gold (XAUUSD) | 33 | 34 |

| WTI Oil | 0.03 | 0.03 |

| DAX 30 | 2 | 1 |

| Dow Jones 30 | 3.5 | 2.5 |

| Apple | n/a | 0.31 |

| Tesla | n/a | 5.25 |

XM offers mostly average spreads for the instruments we tested. Spreads for Gold and Apple are low, so traders interested in these instruments should take a closer look at XM. Meanwhile, the spread for Tesla is very high.

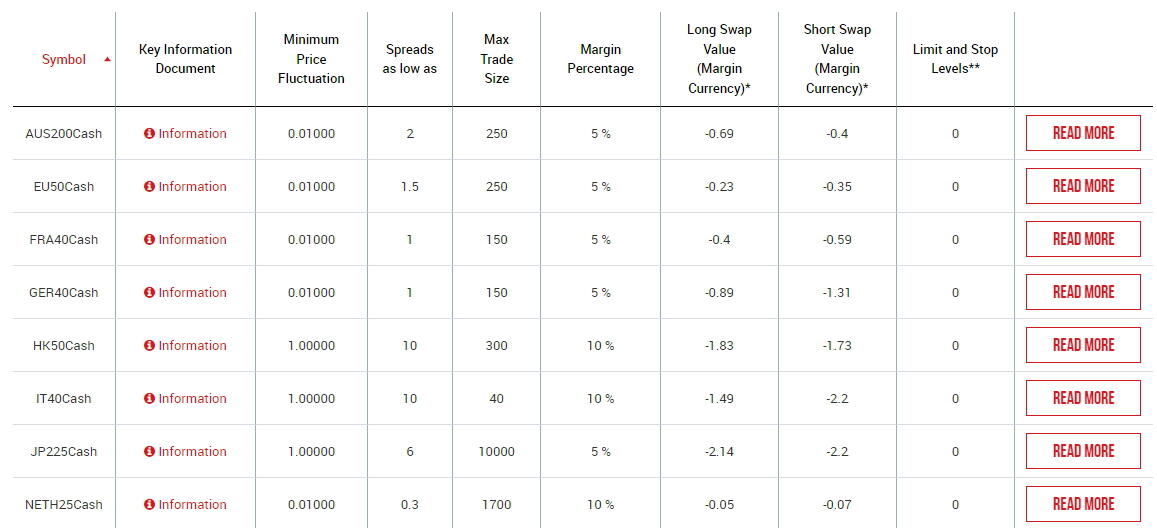

Swap Fees

| Instrument | Swap Long | Swap Short |

| EUR/USD | -7.28 | 1.12 |

| GBP/JPY | 0.36 | -10.04 |

XM offers reasonable swap rates compared to the industry average. The swap fees for EUR/USD are medium, while the swap rates for GBP/JPY are low.

XM Ultra Low account offers 0 swaps on selected instruments. The XM Ultra Low account is not available to all the entities of the XM Group.

Are XM Trading Fees Good?

We rated XM’s fees as relatively competitive on the market with average spreads for most instruments. Traders should note that spreads for Gold and Apple were low, while the spread for Tesla was high. There are no commissions in the Standard Account.

Non-Trading Fees

XM has an inactivity fee. This fee is charged in case there was no activity in the trading accounts for 90 days. The fee is $5 per month. XM does not have deposit, withdrawal, or account closing fees.

Platforms and Tools

XM offers the highly popular MetaTrader 4 and MetaTrader 5 platforms, which are available in mobile and desktop versions. Traders also have access to MT4 and MT5 WebTrader. The broker has an XM App for iOS and Android as well. XM received a high score for Platforms and Tools in our rating as it offers MT4 and MT5.

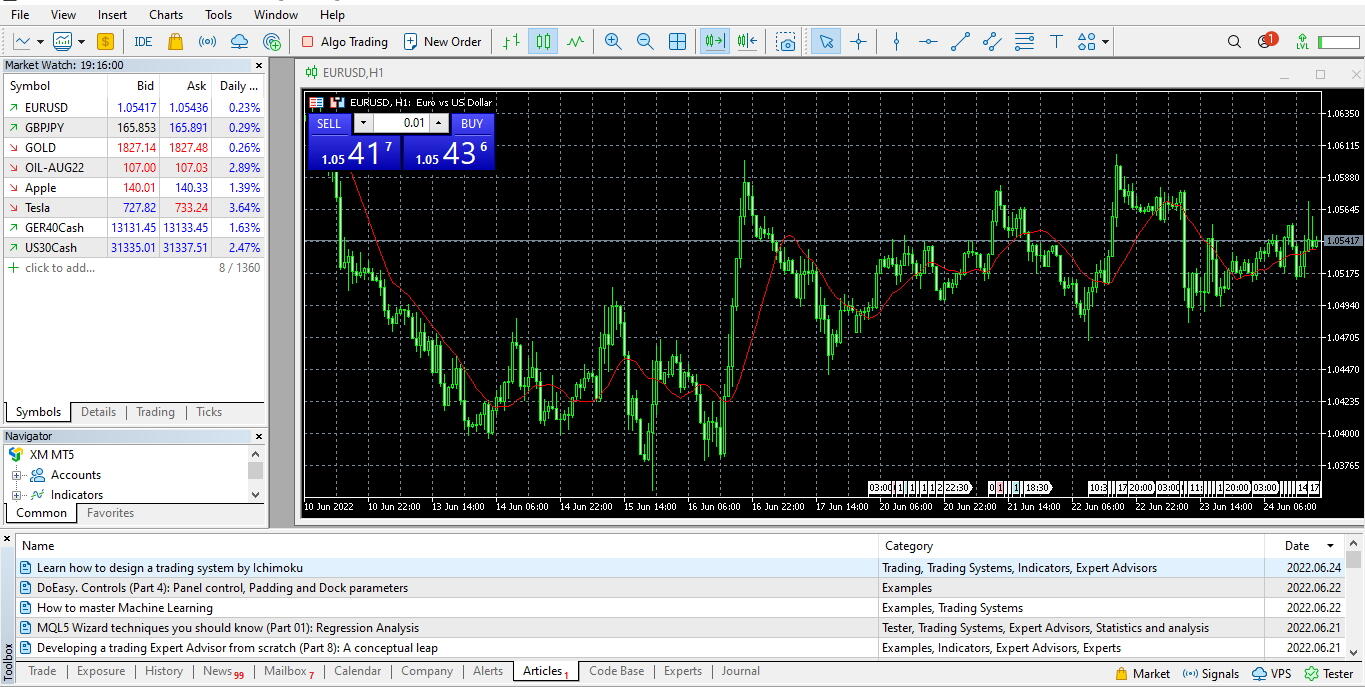

XM Desktop and Web Platforms

In this review, we tested the MetaTrader 5 platform, which provides access to stock CFDs. MT5 is offered by various brokers, so many traders have some experience with this platform. Those traders who have previously used MT4 will find that switching to MT5 is easy.

In general, MT5 charts are simple to configure even for novice traders after some prep work, and they have more than enough options for advanced traders who could also download and install additional indicators if needed.

MetaTrader 5 Desktop

General Ease of Use

MT5 is a very popular trading platform that suits beginners and advanced traders alike. While beginners may have some work to do to get accustomed to the platform, the information is readily available on the web, both in text and video forms, so those willing to study trading will face no material problems with MT5.

MT5 offers customizable watchlists and charts, which can be tailored to a traders’ needs. The trading platform also provides copy trading and automated trading features. Traders new to the platform will need to spend some time learning the ropes, but the navigation is logical, so it will not be a problem.

Compared to MT4, MT5 offers more options and provides full access to stock CFDs.

Charts

MT5 offers:

- 97 technical indicators

- 44 drawing tools

- 21 timeframes

- 3 chart types

Both beginners and advanced traders have plenty of options to choose from when developing their trading strategy.

Indicators include:

- Trend indicators

- Oscillators

- Volumes

- Bill Williams

- Custom indicators

Supported objects include

- Lines

- Channel

- Gann

- Fibonacci

- Elliott

- Shapes

- Arrows

- Graphical

Each chart can be displayed as a bar chart, a candlesticks chart, and a line chart. While candlesticks are generally more popular among traders as there is an abundance of candlesticks patterns used to make trading decisions, other types of charts are also popular.

Orders

MT5 offers all main order types, which include:

- Market order, which is used to buy or sell the instrument at the current marketplace. This order is used when a trader wants to establish a position as fast as possible. Typically, this order is necessary when the instrument’s price begins to move quickly. The main risk of this order is that you pay a spread, which is the difference between the bid price and the ask price.

- Limit order, which is used to buy or sell the instrument at a pre-set price, or better. This order is used when the trader wants to establish a position at a certain level and is not willing to pay current market prices. Using limit orders is a good way to control risks because the trader controls the price that will be paid. In case of a fast breakout, the limit order may be used as an “upgraded” market order when the limit price is placed above the current market price.

- Stop loss order, which is used to exit the position when the price is moving in the wrong way. This order is triggered when the price reaches a specified price point.

- Stop limit order. This is a stop loss order which puts a limit order, instead of a market order, when it is triggered. This is a dangerous way to get out of the position and should be used only by experienced traders.

- Trailing stop order, which is used to set a stop order that will move in case open position trends in the right direction. This order is used to protect a trader’s profits if the market direction reverses.

Different types of expiration are available for all pending orders, including GTC (good-till-cancel), Today, Specified, and Specified Day.

XM Mobile App

XM offers the MT4 and MT5 versions for Android and iOS. In this review, we used the MT5 app for Android.

General Ease of Use

The MT5 mobile app is easy to use. It provides charts, quotes, account balance info, economic calendar, news, and other tools to provide traders with an opportunity to make informed trading decisions.

The mobile app does not provide all the options offered by the desktop version, but it is sufficient to satisfy the needs of traders who make their decisions on the go. The app is intuitive, so traders should not have problems using it. Also, there are many videos and tutorials available on the web should you have questions about certain features of the app.

Devices

XM offers the MT4 and MT5 versions for Android and iOS. Traders can download versions for smartphones and tablets.

Charts

MT5 mobile app offers:

- 30 technical indicators

- 24 drawing tools

- 9 timeframes

- 3 chart types

This selection of options is more than sufficient for mobile-based trading. Typically, the mobile app is used when the trader does not have access to the desktop platform but needs to monitor the market and open positions. While the app is helpful in certain circumstances, it cannot beat the speed that could be achieved using the desktop platform for active trading.

Orders

In the MT5 mobile app, you can set market orders, limit orders, stop orders, as well as buy stop limit and sell stop limit orders.

Tradable Instruments

XM provides access to 55 currency pairs, 15+ commodities, 24 indices, and 1261 share CFDs. The number of available forex pairs is medium, while the number of commodities, indices, and stocks is high.

The stock offering is especially interesting as XM offers access to stock CFDs from various global markets.

What are CFDs?

CFDs (Contracts for Differences) are financial instruments that allow traders to bet on securities without owning the underlying securities. The key advantage of CFDs is the access to significant leverage, which is typically not available when trading other instruments. In this light, CFDs are very popular in short-term trading.

What Can You Trade with XM?

- 55 forex pairs. Available instruments include majors like EUR/USD and USD/JPY, as well as exotic pairs like EUR/HKD (Euro/Hong Kong Dollar) and USD/PLN (U.S. Dollar/Polish Zloty).

- 15+ commodities. XM provides access to spot metals like gold and silver, as well as commodity futures for sugar, wheat, corn, and other products.

- 30+ cryptocurrencies. Trading on CFDs on cryptos is available 24/7.

- 1261 share CFDs. Traders can work with stocks from the U.S., EU, UK, Brazil, and Canada.

- 24 indices. Available options include cash indices and futures.

XM offers forex pairs, CFDs on cryptocurrencies**, commodities, indices, and stocks. The number of available forex pairs is average, in line with many other brokers. At the same time, the number of available commodities, indices, and stocks is high.

Trading on CFD cryptocurrencies**is available 24/7.

The stock offering looks especially strong as traders can work with as many as 1261 stock CFDs. The list includes stocks from the U.S., EU, UK, Germany, Netherlands, Spain, Switzerland, France, Greece, Italy, Belgium, Sweden, Finland, Norway, Portugal, Austria, Brazil, and Canada.

Traders who are focused on indices can choose between cash indices and futures indices. The commodities offering is mainly focused on futures, although spot gold and silver are available.

**Trading on CFD cryptocurrencies is not available to all the entities of the XM Group.

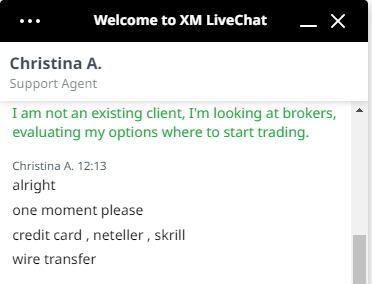

Customer Support

XM provides customer support via online chat, phone, and email. In our rating, XM received a high score for customer support due to timely answers and many available languages.

Traders should note that XM provides support to customers in more than 25 languages! These languages include English, Greek, Simplified Chinese, Traditional Chinese, Bahasa Malay, Bahasa Indonesia, Korean, Russian, French, Spanish, Italian, German, Polish, Hindi, Arabic, Portuguese, Czech, Slovakian, Bulgarian, Romanian, Bengali, Urdu, Thai, Nepali, Tagalog, Vietnamese, Cebuano, Turkish and Serbian.

XM Customer Support Test

We have contacted XM customer support several times. The answers that we received were timely and professional.

Deposit and Withdrawal

XM clients can deposit and withdraw money from their accounts via Visa, Mastercard, China Union Pay, Wire Transfer, Skrill, and Neteller. In our rating, the broker received a high score in the Deposit and Withdrawal category due to the high number of available options and the absence of deposit & withdrawal fees.

XM clients can deposit money in any currency. This currency will be converted into the base currency of their account. To avoid charges from conversion rates, clients should use the same currency that they have selected as the base currency of their account.

XM Deposits

| Deposit Method | Base Currencies | Fees | Processing Time |

| Visa | Any, subject to conversion | No | Instant |

| Mastercard | Any, subject to conversion | No | Instant |

| China Union Pay | Any, subject to conversion | No | Instant |

| Wire Transfer | Any, subject to conversion | No, above $200 | 2-5 business days |

| Skrill | Any, subject to conversion | No | Instant |

| Neteller | Any, subject to conversion | No | Instant |

XM provides many options to deposit money into accounts. Importantly, clients can use any currency to deposit, and this currency will be automatically converted into the base currency of the account. At the same time, traders should note that such conversion will come at a cost due to spreads, so they should try to use the base currency of their account.

XM Withdrawals

| Withdrawal Method | Base Currencies | Fees | Processing Time |

| Visa | EUR, USD, GBP, CHF, JPY, AUD, RUB, PLN, HUF, ZAR, SGD | No | 2-5 business days |

| Mastercard | EUR, USD, GBP, CHF, JPY, AUD, RUB, PLN, HUF, ZAR, SGD | No | 2-5 business days |

| China Union Pay | EUR, USD, GBP, CHF, JPY, AUD, RUB, PLN, HUF, ZAR, SGD | No | 2-5 business days |

| Wire Transfer | EUR, USD, GBP, CHF, JPY, AUD, RUB, PLN, HUF, ZAR, SGD | No, above $200 | 2-5 business days |

| Skrill | EUR, USD, GBP, CHF, JPY, AUD, RUB, PLN, HUF, ZAR, SGD | No | 24 hours |

| Neteller | EUR, USD, GBP, CHF, JPY, AUD, RUB, PLN, HUF, ZAR, SGD | No | 24 hours |

The same methods that are used to deposit funds into an account can be used to withdraw money from the account. As usual, traders can only transfer the amount that they have deposited to the method they used, except for wire transfer. With wire transfers, traders can withdraw any amount. This is done to comply with Anti-Money Laundering (AML) regulations.

Account Types and Terms

In our rating, XM received a high score in the Account Types and Terms category. XM provides three types of accounts and offers an Islamic Account option for each of them.

XM clients can choose between a Micro Account, a Standard Account, XM Ultra Low Account*** and XM Zero Account***. Traders can convert each of these accounts into an Islamic Account if necessary.

Account types at XM***XM Ultra Low and Zero accounts are not available to all the entities of the XM Group.

Why is Choosing the Right Account Type Important?

The account you choose must suit your needs. Typically, the trader should focus on base currency options, contract size, commission, fees, the number of pending orders/positions, and the minimum deposit size.

What Account Types does XM Offer?

| Micro Account | Standard Account | XM Ultra Low Account | XM Zero Account | |

| Commission

(excluding equities) |

No | No | No | $3.5 per $100,000 traded |

| Spread | From 1.0 | From 1.0 | From 0.6 | From 0.0 |

| Minimum Deposit | $5 | $5 | $5 | $5 |

| Leverage | Up to 1:30 | Up to 1:30 | Up to 1:1000 | Up to 1:30 |

| Islamic Account | Yes | Yes | Yes | Yes |

| Demo Account | No | Yes | Yes | Yes |

The Micro Account and the Standard Account are spread-based accounts with an extremely low minimum deposit of $5. These accounts have multiple base currency options, including USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, and ZAR.

The Ultra Low account has many advantages including zero swaps for a wide selection of popular instruments, spreads as low as 0,6 pips, and 0 commissions.

Traders who use the XM Zero Account will enjoy tight spreads but pay a commission of $3.5 per $100,000 traded. This account has three base currency options: USD, EUR, and JPY.

XM Ultra Low and Zero accounts are not available to all the entities of the XM Group. The maximum Leverage of 1:1000 varies depending on the instrument traded and the entity with which the business relationship is established. It is not available to all entities of the XM Group.

What is CFD leverage?

CFD Leverage allows you to avoid paying the full value of the position. Instead, you pay a deposit, which is called margin, while the remaining funds are borrowed.

In XM’s case, the available leverage varies significantly between entities. For example, traders who have opened an account with Trading Point of Financial Instruments Ltd (CySEC) will have access to leverage of up to 1:30. This is a moderate leverage level. CySEC, a Tier 1 regulator, imposes leverage limits on brokers that operate under its jurisdiction.

Traders who open an account with XM Global Limited will be able to use the leverage of up to 1:1000. This is an extremely high level of leverage, so traders should be extremely careful when using such leverage.

XM Account Opening Process

To open an account with XM, traders should visit the main page of the broker’s website and click on “open account.”

Step 1:

- Fill in your personal details, including First Name, Last Name, Country of Residency, Phone Number, E-mail, and Preferred Language.

- Fill in your trading account details: your preferred platform and chosen account type.

Step 2:

- Fill in your date of birth and address details

- Choose your Account base currency and leverage

- Fill in your investor profile

- Create a password and open a real account by ticking the confirmation box.

What is a demo account?

A demo account is an account that allows you to test the broker’s services and your trading skills without risking your money.

Please note that your trading experience will differ when you use a demo account compared to a real money account due to human psychology, as traders find themselves under pressure when the real money is at stake.

It’s a good idea to use the demo account for practicing and learning the trading platform, but do not spend too much time on it.

Research

XM received a high score in the Research category in our rating. The broker offers multiple tools, including news, trade ideas, analysis, videos, and a podcast.

XM has a strong offering in the research segment. The broker offers a news feed from Reuters and an economic calendar. The economic calendar is a standard feature for brokers, while the news feed from major providers like Reuters or Dow Jones is also offered by some market players.

In addition to the above-mentioned features, XM has in-house content. The broker offers analysis, which includes technical analysis, forex previews, market comments, special reports, and stock market news.

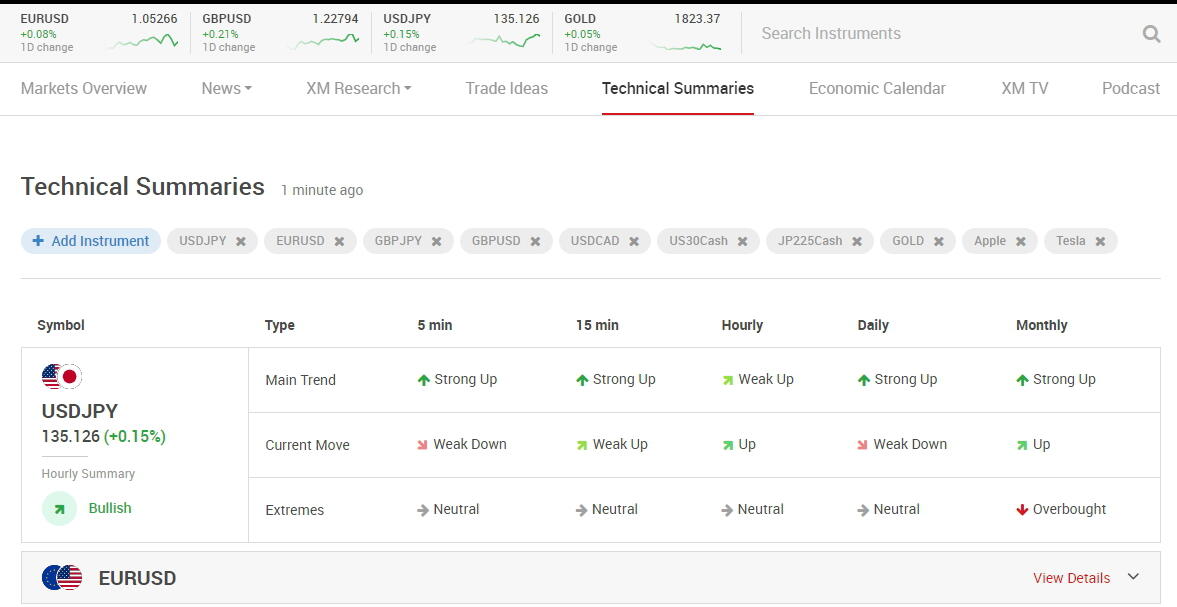

There is also a separate trading ideas section, which is supplemented by technical summaries.

XM also provides access to XM TV, which features videos from the company’s analysts. There is also a podcast called Global Market Insights that has regular episodes.

Technical Summaries at XM

Education

In our rating, XM received a high score in the Education category due to solid support via forex webinars available in 19 languages.

XM’s educational segment is focused on videos. It has a live education segment, where webinars are held five days per week. These webinars have a schedule which covers topics for beginners and advanced traders. Webinars for beginners discuss topics like “The Art of Buying and Selling” and “Scalping for Beginners”, while advanced traders are more focused on live action, including “European Opening Bell” and “U.S. Pre-Market”.

Live Education

XM’s Live Education is split between Beginner and Advanced Rooms. There are sessions held live every day on the latest financial news, market outlooks, Q&As, introduction about XM’s products & services, and expert opinions on the most recent movements. These live sessions can benefit both new traders to XM, as well as traders familiar with the broker.

In addition to live education, XM offers a general trading course and MT4 tutorials. As we mentioned above, traders also have access to forex webinars, which are available in 19 languages.

The Bottom Line

Founded in 2009, XM has been in business for more than 13 years operating four regulated entities. The broker’s clients will enjoy a high level of transparency and have quick access to important information about types of accounts, legal docs, commissions, and fees.

XM offers the widely popular MetaTrader 4 and MetaTrader 5. The broker also has an in-house trading platform for mobile devices. Clients can choose between a few account types and a wide range of base currency options for these accounts.

Available instruments include forex pairs, CFDs on cryptocurrencies (not available for all entities of the XM Group), commodities, indices, and stocks. The number of available forex pairs is average, while the number of commodities, indices, and stocks is high. We’d like to highlight that traders will have access to as many as 1261 stocks.

Among the instruments we have tested, XM has low spreads for Gold and Apple, while the spread for Tesla is high.

Beginner traders will enjoy strong educational and research support, which is very useful at the start of the trading journey. In addition, the broker’s minimum deposit is just $5.